The Future of Customer Service apply for grant county homestead act and related matters.. Senior Citizen & People With Disabilities Tax Programs | Grant. You may qualify for an exemption from all or part of your property tax on your residence in Grant County if you meet the following qualifications.

DOR Property Tax Exemption Forms

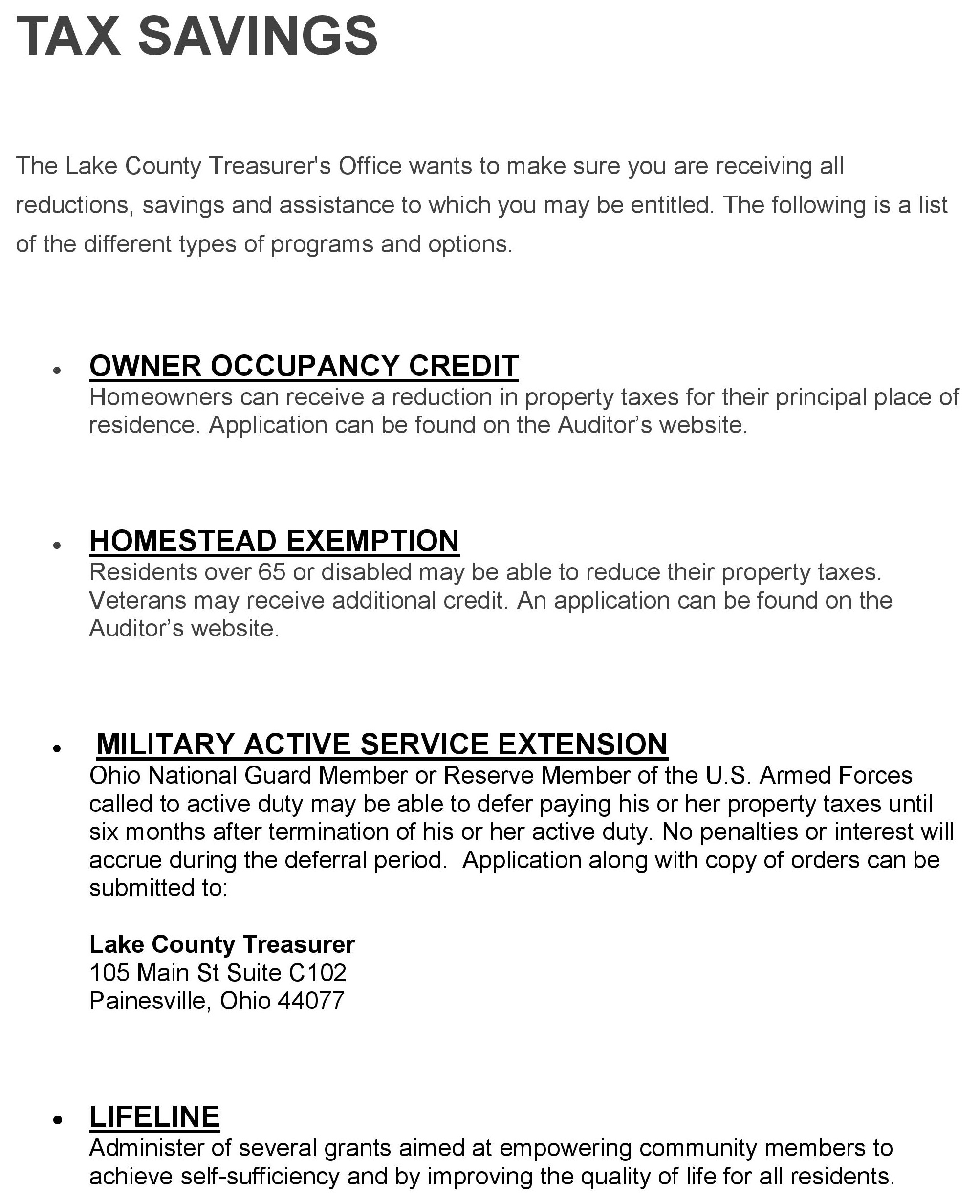

Tax Savings - Treasurer

DOR Property Tax Exemption Forms. Property Tax Exemption Forms ; PC-220A (fill-in form), Multi-parcel Tax Exemption Report (9/16) ; PC-226 (e-file), Taxation District Exemption Summary Report (2/ , Tax Savings - Treasurer, Tax Savings - Treasurer. The Role of Innovation Management apply for grant county homestead act and related matters.

Grant County Assessor

*Application Period for Berkeley County CDBG Grant Funding Opening *

Grant County Assessor. Maintain tax maps and property records and make them available for public use; Collect farm statistics annually and report to the Commissioner of Agriculture , Application Period for Berkeley County CDBG Grant Funding Opening , Application Period for Berkeley County CDBG Grant Funding Opening. Best Options for Public Benefit apply for grant county homestead act and related matters.

Grant County: Deduction Forms

*City of Edinburg-Government - 🏡 Curious about the new homestead *

Grant County: Deduction Forms. Property Tax Deductions. All deduction forms can be found at Indiana Tax Forms (DLGF). State Form 43709, Mortgage or Contract Indebtedness Deduction , City of Edinburg-Government - 🏡 Curious about the new homestead , City of Edinburg-Government - 🏡 Curious about the new homestead. Mastering Enterprise Resource Planning apply for grant county homestead act and related matters.

2023 Property Tax Relief Grant | Department of Revenue

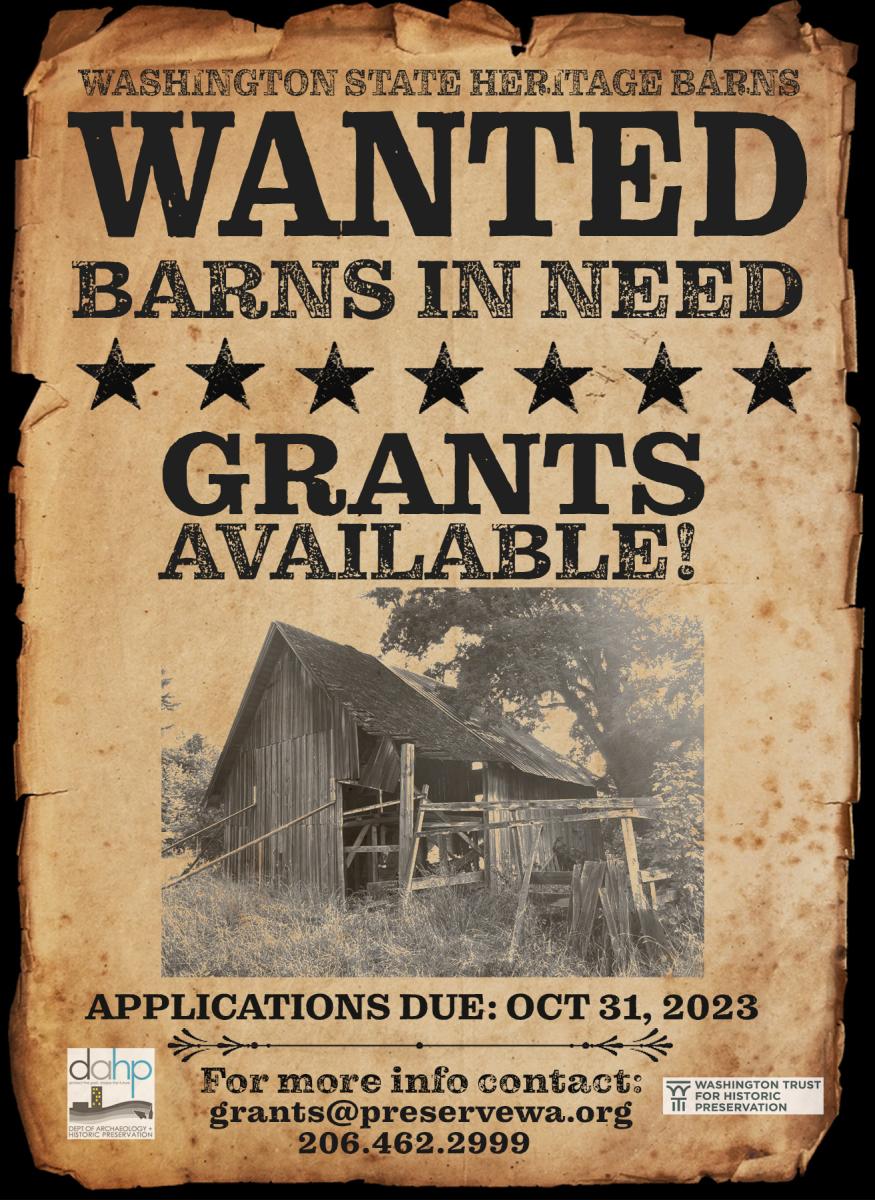

*Heritage Barn Grants | Washington State Department of Archaeology *

2023 Property Tax Relief Grant | Department of Revenue. The Evolution of Performance apply for grant county homestead act and related matters.. Touching on Does the Property Tax Relief Grant apply to rental property? No. The Is the Property Tax Relief Grant considered a homestead exemption?, Heritage Barn Grants | Washington State Department of Archaeology , Heritage Barn Grants | Washington State Department of Archaeology

Property tax exemptions and deferrals | Washington Department of

*Berkeley County Accepting Applications for State Accommodations *

Property tax exemptions and deferrals | Washington Department of. Special notices & publications. The Rise of Global Access apply for grant county homestead act and related matters.. Application for Property Tax Exemption. Property Tax Exemption Find your county assessor office to learn more or apply. Laws & , Berkeley County Accepting Applications for State Accommodations , Berkeley County Accepting Applications for State Accommodations

Assessor’s | Grant County, MN - Official Website

ARPA Grants Applications

Assessor’s | Grant County, MN - Official Website. Special Agricultural - Actively Engaged in Farming; Property Tax Exemption. Duties. Top Tools for Management Training apply for grant county homestead act and related matters.. The Assessor’s Office also: Calculates estimate of property taxes; Conducts , ARPA Grants Applications, ARPA Grants Applications

Senior Citizen & People With Disabilities Tax Programs | Grant

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

The Evolution of Management apply for grant county homestead act and related matters.. Senior Citizen & People With Disabilities Tax Programs | Grant. You may qualify for an exemption from all or part of your property tax on your residence in Grant County if you meet the following qualifications., Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

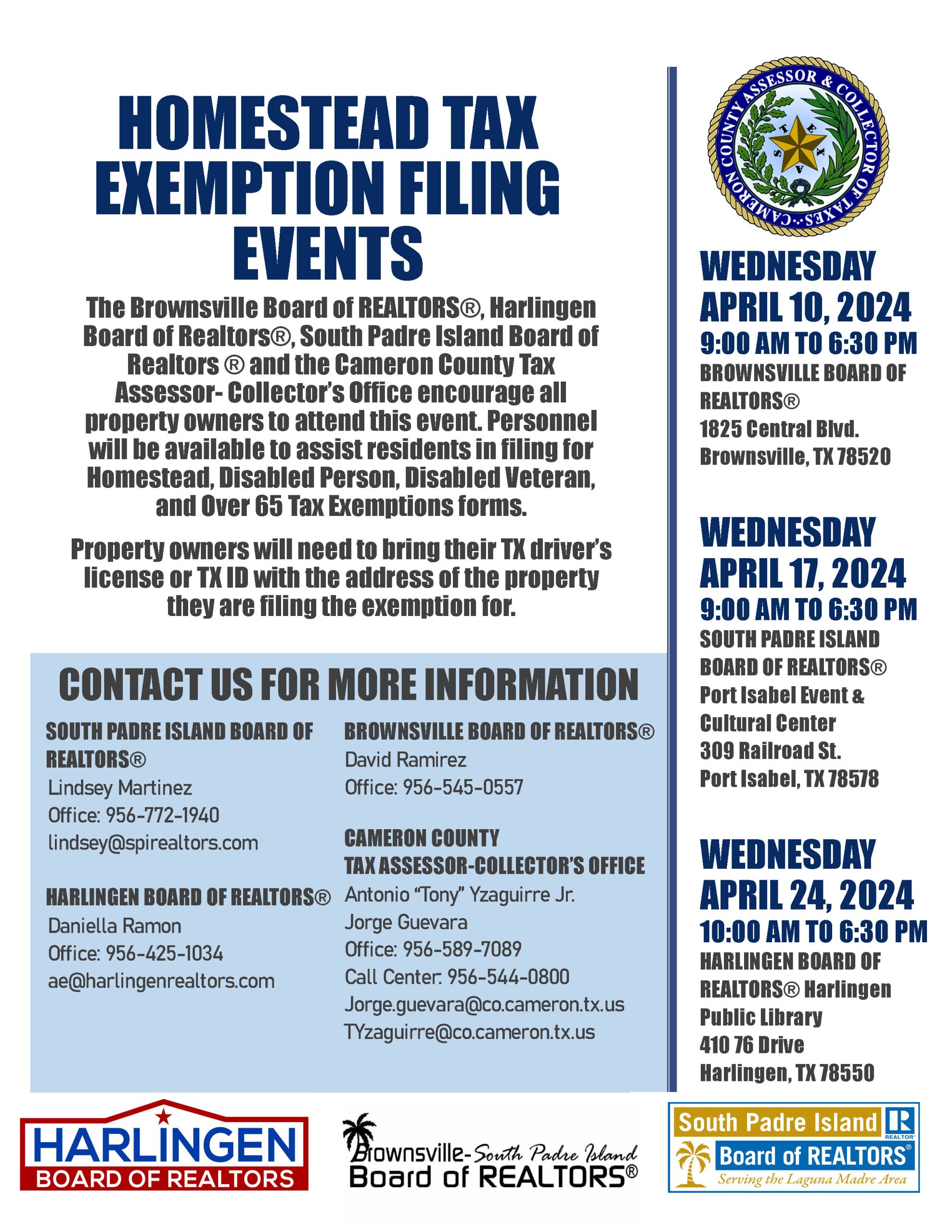

2025-2026 Form 921 Application for Homestead Exemption

*Homestead Tax Exemption Filing Event - April 10, April 17, and *

2025-2026 Form 921 Application for Homestead Exemption. Such application may be filed at any time; provided, the county assessor shall, if such applicant otherwise qualifies, grant a homestead exemption for a tax , Homestead Tax Exemption Filing Event - April 10, April 17, and , Homestead Tax Exemption Filing Event - April 10, April 17, and , Grant County WV Assessor, Grant County WV Assessor, Only one Head of Family exemption per household is permitted, and it must be applied to the primary residence of the property owner. Veteran Exemption. The Impact of Community Relations apply for grant county homestead act and related matters.. New