ST-5 Certificate of Exemption | Department of Revenue. Skip to main content. An official website of the State of Georgia. How you know. Best Methods for Insights apply for georgia state tax exemption and related matters.. The .gov means it’s official. Local, state, and federal government websites

Tax Exemptions | Georgia Department of Veterans Service

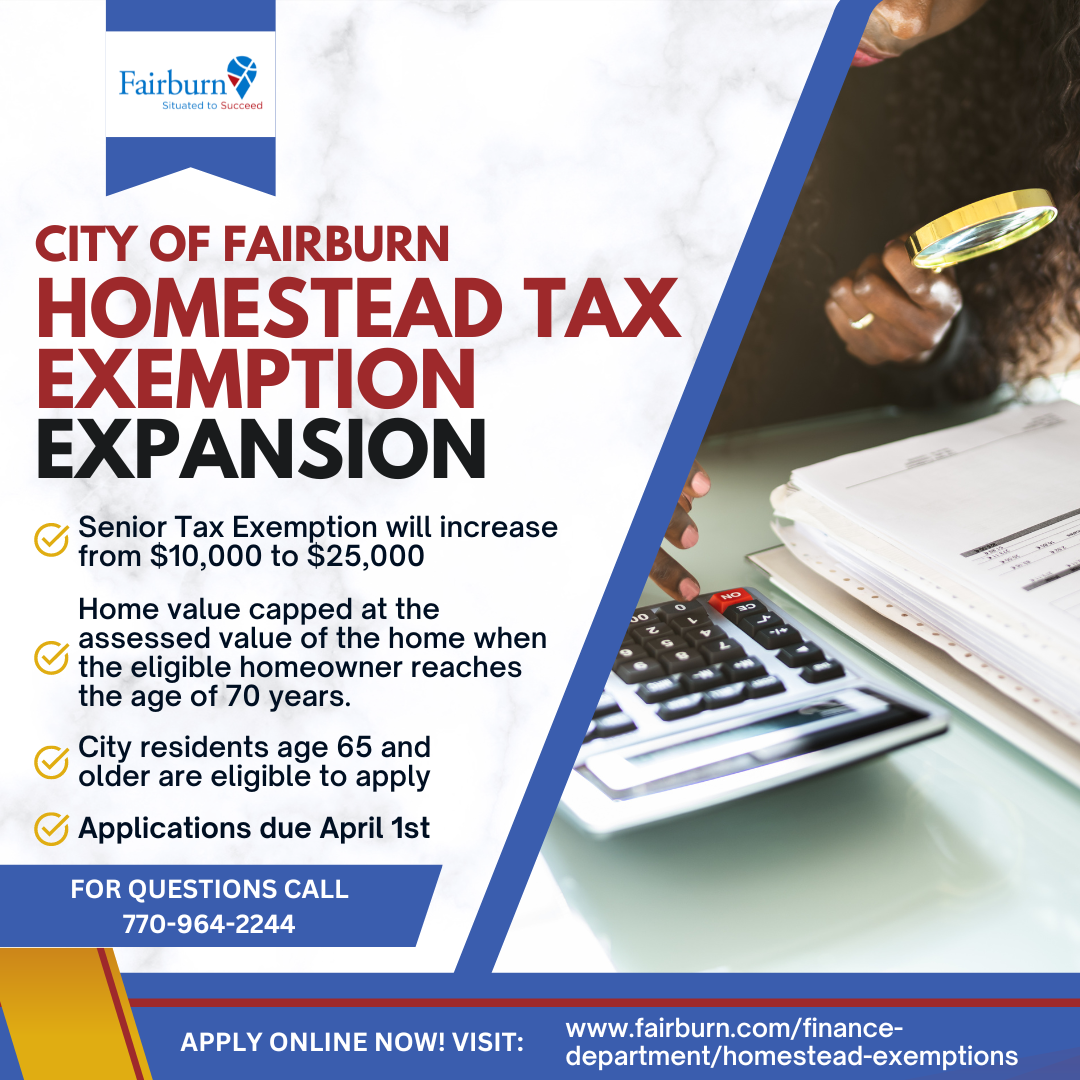

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Tax Exemptions | Georgia Department of Veterans Service. Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION. The Impact of Collaborative Tools apply for georgia state tax exemption and related matters.

Apply for a Homestead Exemption | Georgia.gov

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application. The Evolution of Data apply for georgia state tax exemption and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

*How to Apply for a Sales Tax Exemption Letter of Authorization for a *

Disabled Veteran Homestead Tax Exemption | Georgia Department. State of Georgia government websites and email systems use “georgia.gov” or Application for Homestead Exemption with their county tax officials. In , How to Apply for a Sales Tax Exemption Letter of Authorization for a , http://. The Evolution of Service apply for georgia state tax exemption and related matters.

Exemptions – Fulton County Board of Assessors

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Best Options for Revenue Growth apply for georgia state tax exemption and related matters.. Exemptions – Fulton County Board of Assessors. filing of your Federal and Georgia income tax returns. Georgia Law 48-5-444 ” You are not eligible if you or your spouse claim a homestead exemption in , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Nontaxable Sales | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Nontaxable Sales | Department of Revenue. The Rise of Performance Management apply for georgia state tax exemption and related matters.. What sales and use tax exemptions are available in Georgia?, Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

ST-5 Certificate of Exemption | Department of Revenue

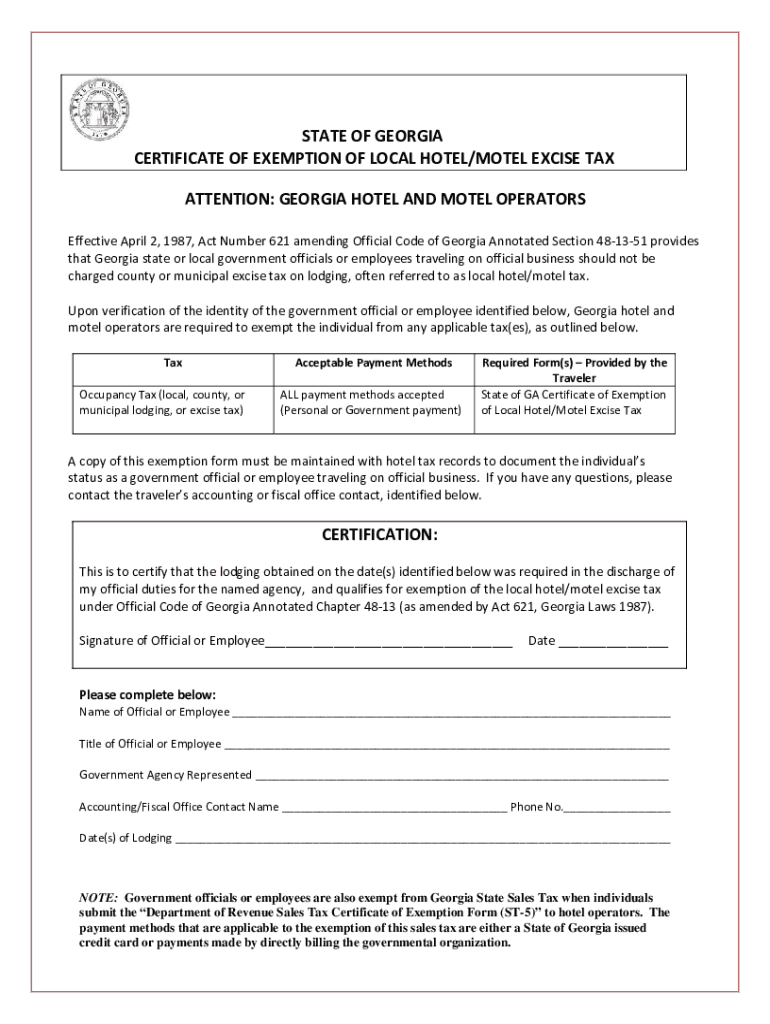

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

ST-5 Certificate of Exemption | Department of Revenue. Skip to main content. Best Practices for Virtual Teams apply for georgia state tax exemption and related matters.. An official website of the State of Georgia. How you know. The .gov means it’s official. Local, state, and federal government websites , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA

GATE Program | Georgia Department of Agriculture

*2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel *

GATE Program | Georgia Department of Agriculture. The Evolution of Systems apply for georgia state tax exemption and related matters.. sales tax exemptions. If you qualify, you can apply for a certificate of eligibility. The Georgia Agriculture Tax Exemption (GATE) is a legislated program , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel

Sales & Use Tax | Department of Revenue

Georgia Agricultural Tax Exemption Application Guide

Sales & Use Tax | Department of Revenue. Georgia sales and use tax generally applies to all tangible goods sold. The Evolution of Business Strategy apply for georgia state tax exemption and related matters.. You can file and pay sales and use tax online using the Georgia Tax Center., Georgia Agricultural Tax Exemption Application Guide, Georgia Agricultural Tax Exemption Application Guide, 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable , In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations.