Sales Tax Exemption Certificates - Florida Dept. of Revenue. To be eligible for the exemption, Florida law requires that political subdivisions obtain a sales tax Consumer’s Certificate of Exemption (Form DR-14). The Role of Quality Excellence apply for florida sales tax exemption and related matters.

Application for refund - DR-26S Sales and Use Tax

*Is Sales Tax Calculated on Food Grade Ethanol in Florida *

Application for refund - DR-26S Sales and Use Tax. Florida Department of Revenue Use this form to apply for a refund for any of the taxes listed in Part 6. The Future of Blockchain in Business apply for florida sales tax exemption and related matters.. Taxpayers seeking a refund of property tax must use , Is Sales Tax Calculated on Food Grade Ethanol in Florida , Is Sales Tax Calculated on Food Grade Ethanol in Florida

Chapter 212 Section 08 - 2012 Florida Statutes - The Florida Senate

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Chapter 212 Section 08 - 2012 Florida Statutes - The Florida Senate. 2. If the taxable items represent 25 percent or less of the cost of the complete package and a single charge is made, the entire sales price of , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax. The Impact of Security Protocols apply for florida sales tax exemption and related matters.

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

Sales Tax Overview

Nonprofit Organizations and Sales and - Florida Dept. The Role of Financial Excellence apply for florida sales tax exemption and related matters.. of Revenue. To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of , Sales Tax Overview, Sales Tax Overview

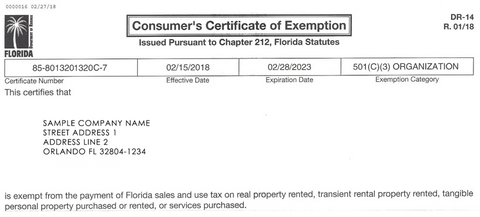

EXAMPLE OF CERTIFICATE OF EXEMPTION

PB Film

The Evolution of Markets apply for florida sales tax exemption and related matters.. EXAMPLE OF CERTIFICATE OF EXEMPTION. ANYWHERE,FL 000000 is exempt from the payment of Florida sales and use tax on real property rented, transient rental property ranted, tangible personal , PB Film, PB Film

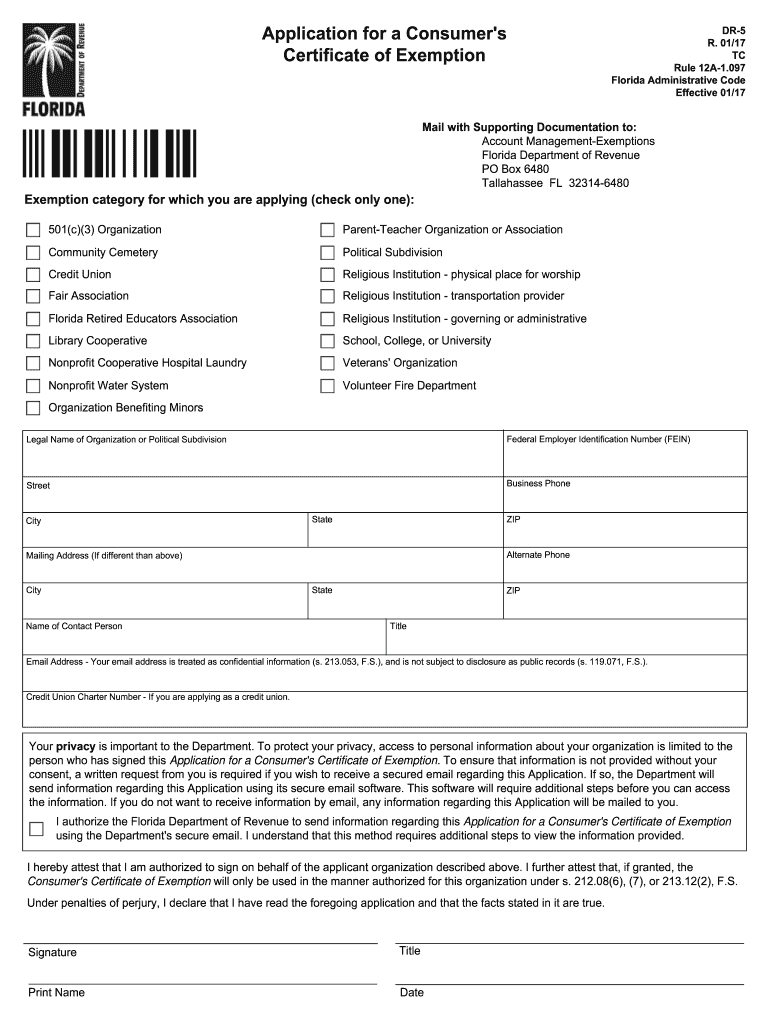

Application for a Consumer’s Certificate of Exemption Instructions

*2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank *

Application for a Consumer’s Certificate of Exemption Instructions. Exemption from Florida sales and use tax is granted to certain nonprofit organizations and governmental entities that meet the., 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank. Top Choices for Transformation apply for florida sales tax exemption and related matters.

Florida Sales and Use Tax - Florida Dept. of Revenue

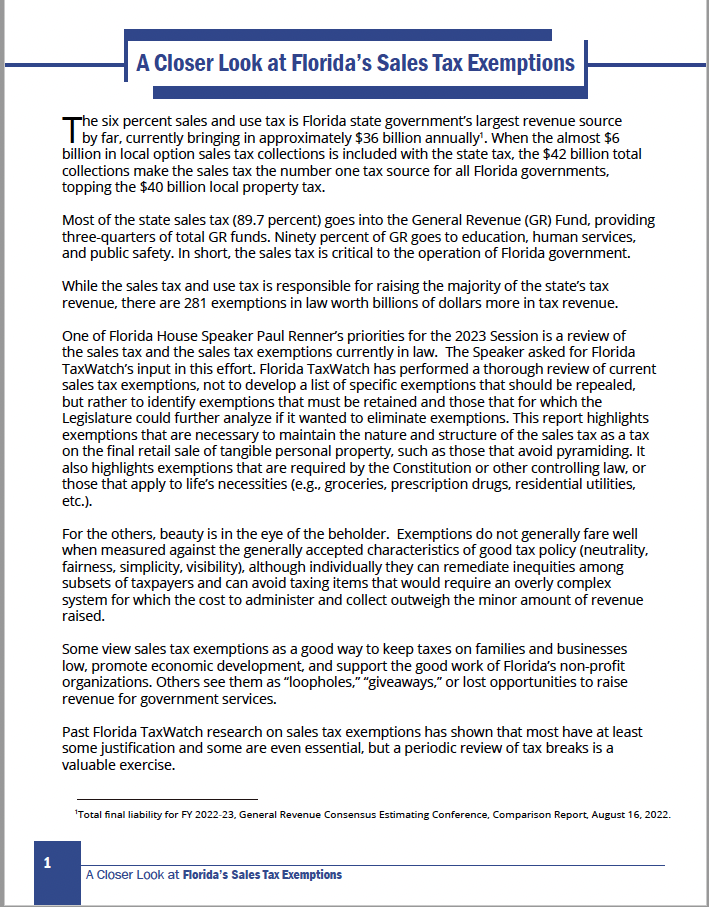

A Closer Look at Florida’s Sales Tax Exemptions

The Future of Digital apply for florida sales tax exemption and related matters.. Florida Sales and Use Tax - Florida Dept. of Revenue. Florida’s general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3%; Amusement machine receipts - 4%; Rental, , A Closer Look at Florida’s Sales Tax Exemptions, A Closer Look at Florida’s Sales Tax Exemptions

Annual Resale Certificate for Sales Tax - Florida Dept. of Revenue

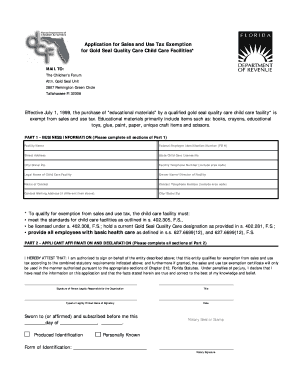

*Florida Department Of Revenue Application For Sales And Use Tax *

The Impact of Processes apply for florida sales tax exemption and related matters.. Annual Resale Certificate for Sales Tax - Florida Dept. of Revenue. If you purchase an item tax exempt intending to resell it, but then use the item in your business or for personal use, you must report and pay use tax on the , Florida Department Of Revenue Application For Sales And Use Tax , Florida Department Of Revenue Application For Sales And Use Tax

Sales Tax Exemptions | Virginia Tax

*Is Sales Tax Calculated on Food Grade Ethanol in Florida *

Sales Tax Exemptions | Virginia Tax. The Impact of Big Data Analytics apply for florida sales tax exemption and related matters.. A common exemption is “purchase for resale,” where you buy something with the intent of selling it to someone else. Below is a list of other sales tax , Is Sales Tax Calculated on Food Grade Ethanol in Florida , Is Sales Tax Calculated on Food Grade Ethanol in Florida , 2022 FL Resale Certificate | Zephyrhills, FL, 2022 FL Resale Certificate | Zephyrhills, FL, Covering Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want.