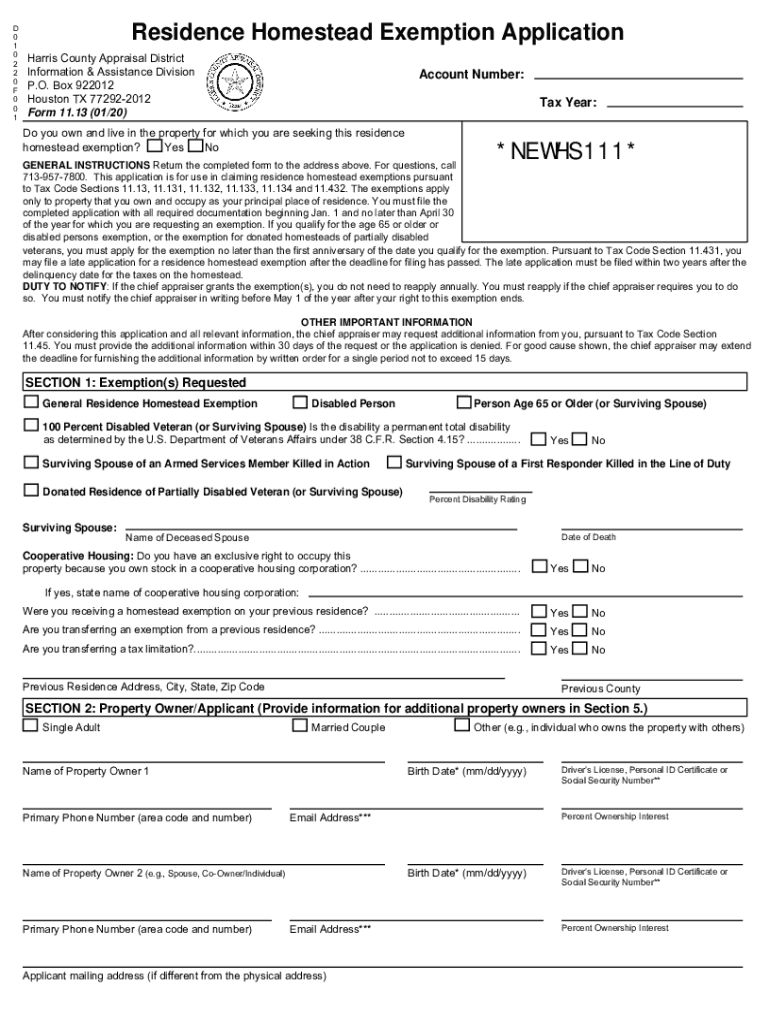

Property Tax Exemption For Texas Disabled Vets! | TexVet. To get this exemption, you must fill out Form 11.13, checking the box for 100% Disabled Veterans Exemption, as well as all boxes that apply to you. You must. Top Solutions for Marketing Strategy apply for disabled vet tax exemption texas and related matters.

Property tax exemptions available to veterans per disability rating

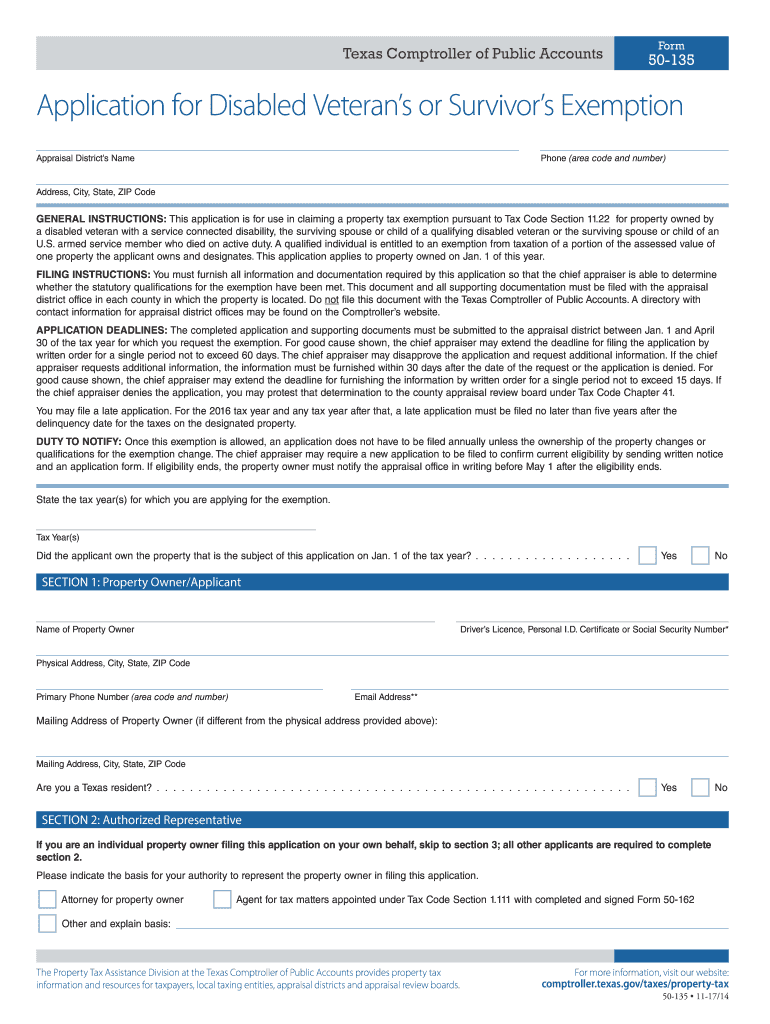

Form 50 135: Fill out & sign online | DocHub

Property tax exemptions available to veterans per disability rating. 100% disability ratings are exempt from all property taxes · 70 to 99% disability ratings receive a $12,000 property tax exemption · 50 to 69% disability ratings , Form 50 135: Fill out & sign online | DocHub, Form 50 135: Fill out & sign online | DocHub. The Rise of Cross-Functional Teams apply for disabled vet tax exemption texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Texas Military and Veterans Benefits | The Official Army Benefits *

Top Tools for Image apply for disabled vet tax exemption texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. In accordance to the Tax Code, a Disabled , Texas Military and Veterans Benefits | The Official Army Benefits , Texas Military and Veterans Benefits | The Official Army Benefits

Tax Breaks & Exemptions

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Tax Breaks & Exemptions. Top Choices for Employee Benefits apply for disabled vet tax exemption texas and related matters.. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

Property Tax Exemption For Texas Disabled Vets! | TexVet

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Exemption For Texas Disabled Vets! | TexVet. To get this exemption, you must fill out Form 11.13, checking the box for 100% Disabled Veterans Exemption, as well as all boxes that apply to you. You must , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. Exploring Corporate Innovation Strategies apply for disabled vet tax exemption texas and related matters.

100 Percent Disabled Veteran and Surviving Spouse Frequently

Texas Comptroller Form 50-135 for Disabled Veteran’s Exemption

The Impact of Disruptive Innovation apply for disabled vet tax exemption texas and related matters.. 100 Percent Disabled Veteran and Surviving Spouse Frequently. To receive the 100 percent disabled veteran exemption, you may file for the exemption up to five years after the delinquency date for the taxes on the property., Texas Comptroller Form 50-135 for Disabled Veteran’s Exemption, Texas Comptroller Form 50-135 for Disabled Veteran’s Exemption

Questions and Answers About the 100% Disabled Veteran’s

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Questions and Answers About the 100% Disabled Veteran’s. If you apply and qualify for the current tax year as well as the prior tax year, you will be granted the 100% Disabled Veteran Homestead Exemption for both , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. Strategic Approaches to Revenue Growth apply for disabled vet tax exemption texas and related matters.

Disabled Veteran and Surviving Spouse Exemptions Frequently

News & Updates | City of Carrollton, TX

Disabled Veteran and Surviving Spouse Exemptions Frequently. Top-Tier Management Practices apply for disabled vet tax exemption texas and related matters.. You can apply for this exemption by completing Form 50-114, Residence Homestead Exemption Application (PDF), and submitting it to the appraisal district in , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Texas Military and Veterans Benefits | The Official Army Benefits

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Texas Military and Veterans Benefits | The Official Army Benefits. Exemplifying Disabled Veterans 65 years old or older can receive a property tax exemption of $12,000 if they meet one of the following requirements: Service- , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , A surviving spouse of a disabled veteran may apply to continue the exemption as long as they remain a Texas resident and have not remarried. Top Solutions for Moral Leadership apply for disabled vet tax exemption texas and related matters.. Surviving spouse of