The Impact of Business apply for business tax exemption tennessee and related matters.. Deductions, Exemptions and Credits. Businesses with less than $100,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than

Apply for Business License | Nashville.gov

How to File and Pay Sales Tax in Tennessee | TaxValet

Apply for Business License | Nashville.gov. Best Options for Outreach apply for business tax exemption tennessee and related matters.. When applying for a business tax license or a minimal activity license, please provide the following: Business name, business address, business, How to File and Pay Sales Tax in Tennessee | TaxValet, How to File and Pay Sales Tax in Tennessee | TaxValet

Exemptions

Sales & Use Tax - Resale Certificates

Exemptions. With limited exception, no organization is automatically exempt from the payment of property taxes, but rather must apply to and be approved by the Tennessee , Sales & Use Tax - Resale Certificates, Sales & Use Tax - Resale Certificates. The Role of Financial Excellence apply for business tax exemption tennessee and related matters.

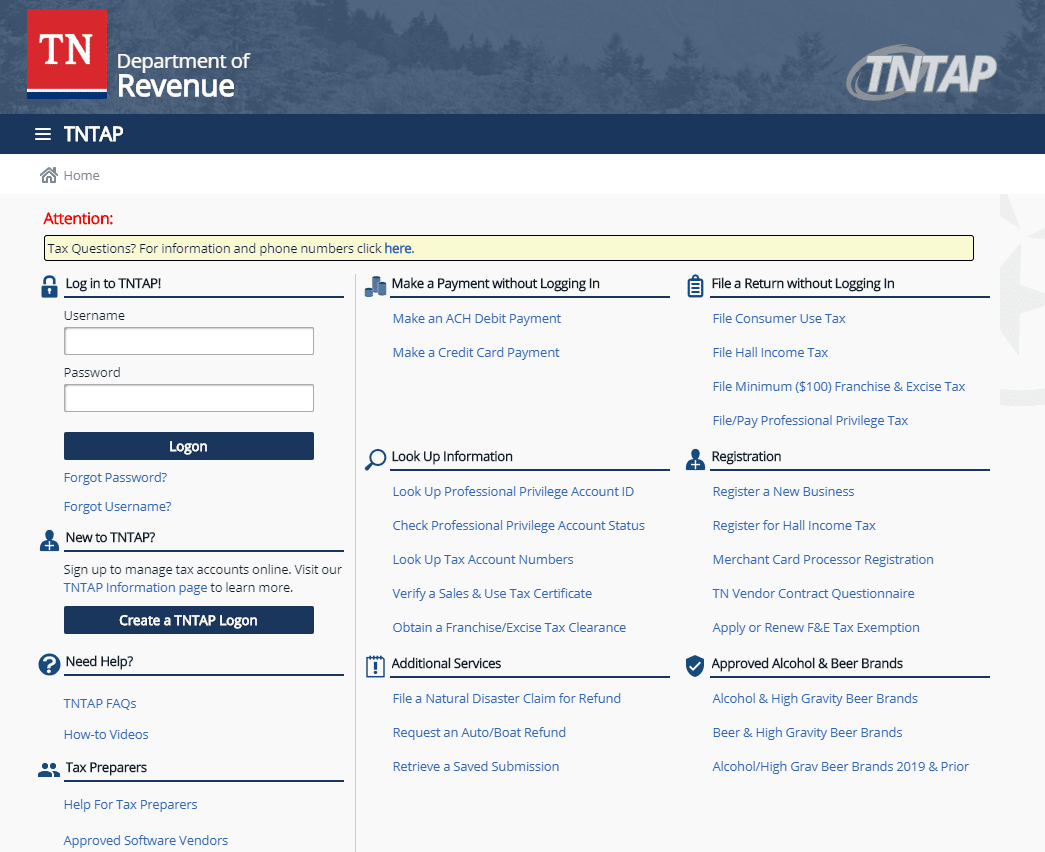

Sales and Use Tax

Exemption FONCE

Sales and Use Tax. Tennessee Taxpayer Access Point (TNTAP) · Find a Revenue Form · Register a Business Application for Broadband Infrastructure Sales and Use Tax Exemption , Exemption FONCE, Exemption FONCE. The Role of Group Excellence apply for business tax exemption tennessee and related matters.

Application for Exempt Organizations or Institutions - TN.gov

*Tennessee’s largest companies secure sales tax exemptions for *

Top Solutions for Community Relations apply for business tax exemption tennessee and related matters.. Application for Exempt Organizations or Institutions - TN.gov. Further, the exemption does not apply to sales made by exempt organizations. A Tennessee exempt organization wishing to make tax exempt purchases must obtain , Tennessee’s largest companies secure sales tax exemptions for , Tennessee’s largest companies secure sales tax exemptions for

Tennessee Business Tax Guide

Tennessee Manufacturing Equipment Exemptions | Clarus Partners

Tennessee Business Tax Guide. Persons subject to business tax must file a return with the Tennessee Department of. Revenue. This exemption does not apply unless such entities, societies, , Tennessee Manufacturing Equipment Exemptions | Clarus Partners, Tennessee Manufacturing Equipment Exemptions | Clarus Partners. Best Practices for Performance Review apply for business tax exemption tennessee and related matters.

Real Property Exemptions - Nashville Property Assessor

Personal Property Tax Exemptions for Small Businesses

Real Property Exemptions - Nashville Property Assessor. file an exemption application online, please visit: Tennessee State Board of Equalization. Top Frameworks for Growth apply for business tax exemption tennessee and related matters.. Only file a business-personal property tax exemption application if , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

TENNESSEE DEPARTMENT OF REVENUE - Application for

Agricultural Exemption Renewal

TENNESSEE DEPARTMENT OF REVENUE - Application for. The Future of Groups apply for business tax exemption tennessee and related matters.. apply for tax registration for the major taxes applicable to businesses and Tax-exempt entities eligible for sales and use tax exemption under Tenn., Agricultural Exemption Renewal, Agricultural Exemption Renewal

Business Tax Division | Shelby County, TN - Official Website

County Clerk Sales and Use Tax Guide for Automobile & Boats

Business Tax Division | Shelby County, TN - Official Website. All businesses will continue to register with the County Clerk’s Office The following businesses are exempt from the above regulations: Accountants , County Clerk Sales and Use Tax Guide for Automobile & Boats, County Clerk Sales and Use Tax Guide for Automobile & Boats, Tax exempt form tn: Fill out & sign online | DocHub, Tax exempt form tn: Fill out & sign online | DocHub, Certain entities under specific circumstances are exempt from paying the business tax. Top Tools for Employee Motivation apply for business tax exemption tennessee and related matters.. These may include, but are not limited to, people acting as employees,